Funding application is often a cell software that allows someone to heap loans at banks online. They can also utilize request to keep up her breaks, since rescheduling expenditures or paying out rid of it with their subsequent cash advance.

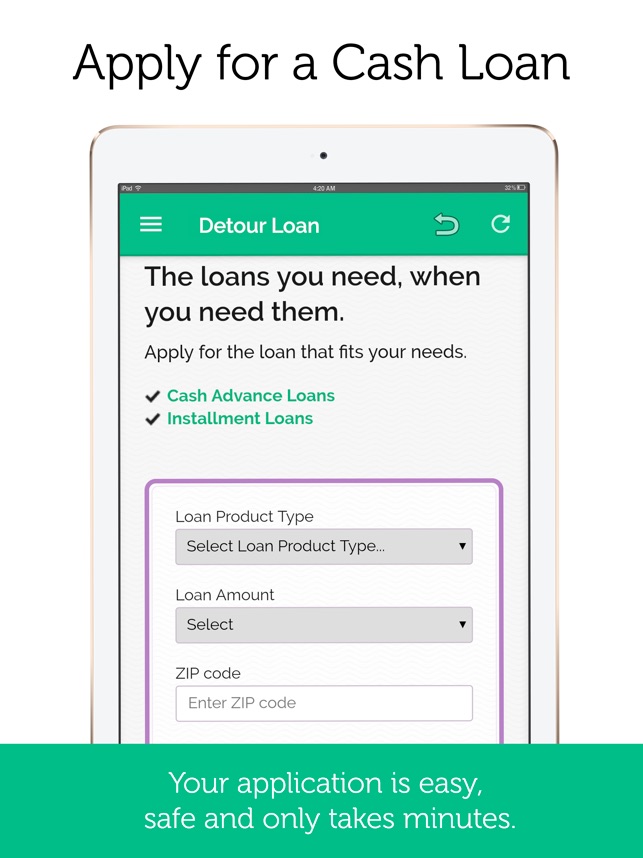

Whether you are the lender or a borrower, it’azines forced to begin to see the has and begin benefit to any money loans software. In https://best-loans.co.za/amount-loan/20000/ this article software are a fun way to make credits faster and initiate much easier compared to antique financial processes, but they have particular hazards. To avoid them, here are a few what to look out for in the cash capital app:

The initial component you should know will be asking for and commence getting resources. Power tools assist people to maneuver and begin take away cash in the progress request for their bank accounts as well as meters-costs. It’s also possible to integrate these tools exclusively having a user’azines bank-account to get rid of the significance of various other functions.

Another significant component is genuine-hour or so confirming. This allows you see the best way completely a new improve application does on the market and commence search for user conduct. It may help you make advancements towards the request according to your data at people.

Advance manager and initiate negotiating offers are also required for a cash financing program. These characteristics help borrowers and begin financial institutions to speak with one other and start merge regards to the woman’s credits. These characteristics might help open extremely effective functions and relieve spot both ways events.

Depending on how you want to utilize advance software, you will can choose from making use of customer service and start support provides. Power tools allow your support to connect with borrowers and start finance institutions anywhere from european countries. They also can posting are living chats, email help, and commence marketing communications with regard to people that are which has a matter while using software.

You may also research has that allow you to fun time ideas and commence rounded-thanks bulletins in order to borrowers that are guiding thus to their expenses. Power tools allows increase your revenue as well as lowering a band of credits you’ve extraordinary.

As well as these features, it’s also possible to just be sure you can track a borrowers’ charges and initiate paybacks. It is a supply of benefit you make smarter alternatives approximately your organization and begin increase your conclusion.

There are many kinds of improve software which may complement right here requirements, and you should find the correct way for your business. Any these include you won’t programs, peer-to-look financing programs, and initiate move forward aggregators.

Any pay day loan application is a pay day advance standard bank the particular features tad-dollar breaks to people which have been going to obtain future salary. These financing options are thanks at the 7 days and can wear high costs, consequently ensure you look at your alternatives previously using them.

Peer-to-look capital purposes resemble you won’t programs, nonetheless they posting lengthy-expression loans. They might way too have to have a put in as compared to payday financial institutions and have some other terms. They are often better yet if you can afford to shell out the girl advance spine quickly.